Dear Editor,

Dear Editor,

I first decided on this subject because of a story in the Wall Street Journal about how European central banks can’t find a way to dial back negative interest rates. No kidding, lesser banks pay the central banks to store their cash.

Let’s Make a Deal

When I was a little kid my dad had me open a savings account at the bank. I put some of my allowance, for feeding the dog and taking out the trash, in there each week.

He explained how if I put money in the bank it would grow. If I wasn’t using that savings for a while, somebody else who had a good idea where to spend it, would pay for the right to use my money.

Since I didn’t know everybody in the world, the bank was the perfect place to connect people who needed money to make money, with those people who had some money but didn’t need it until later.

I deposited my savings and earned 4%. A borrower paid 5% and the bank took 1% as pay for providing the service.

Banking and money are no longer that simple.

In 1913 a series of financial panics led to the creation of America’s central bank, The Federal Reserve.

To put the founding of The Fed in perspective, this definition from Google is very revealing: “Panic: sudden uncontrollable fear or anxiety, often causing wildly unthinking behavior.” That panic was put to use in a big way by banks who discovered that “wildly unthinking behavior” equals opportunity.

Banks receive new money from The Fed at little or no interest that they can loan and collect interest on. Anyone holding dollars as that money enters circulation has wealth taken through a devaluation of their savings by an increase in the money supply by The Fed. (Look at it this way, if there are 10 billion bushels of corn and that is suddenly increased to 12 billion, what would that do to the price per bushel?)

If you saw that inflation caused the value of your money to buy less next year, why would you save for the future? The government mandates The Fed to keep inflation at 2% to “stimulate growth.”

What it really does is create an illusion of growth. If a stock goes up in price but it is actually stagnant and the value of the money to buy that stock requires that it takes more of those cheaper dollars to buy it, is that really growth?

The purpose of The Fed is not to stabilize the economy, it is to move wealth from poor holders of cash to those politically well connected. Increases in stock prices and employment built on fake prosperity isn’t sustainable. It is robbing from future generations and encouraging malinvestment and discouraging savings. Savings used to be the basis for growth because that capital was available, at a cost, for expanding and founding business. Now with a fake economy, growth is not based on real supply and demand. It is based on government subsidies and mandates.

The growing divide between rich and poor didn’t start with the current income inequality craze. It started in 1913. But like the frog in the pot slowly coming to a boil, all of a sudden we realize a huge part of the fruits of our labor go to someone that didn’t have a hand in creating it.

The stable economy promised by The Fed is more likely achievable with no intervention at all, such as a kid wanting to grow his savings and a borrower with a good idea needing cash. Interest rates determined by a committee will never bring us an economy as stable as one created by millions of selfish individuals and a guaranteed right to keep what they earn.

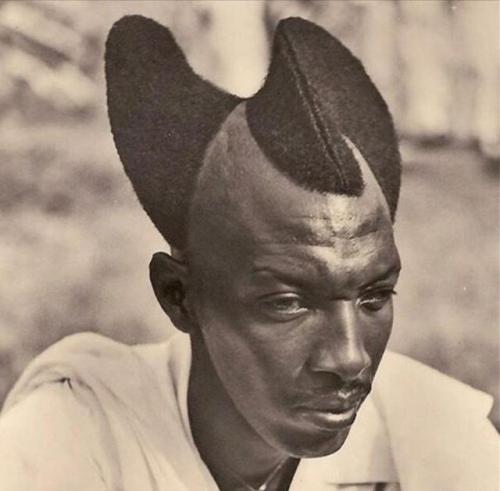

This is style!

Break it, fix it, break it, fix it, break it….

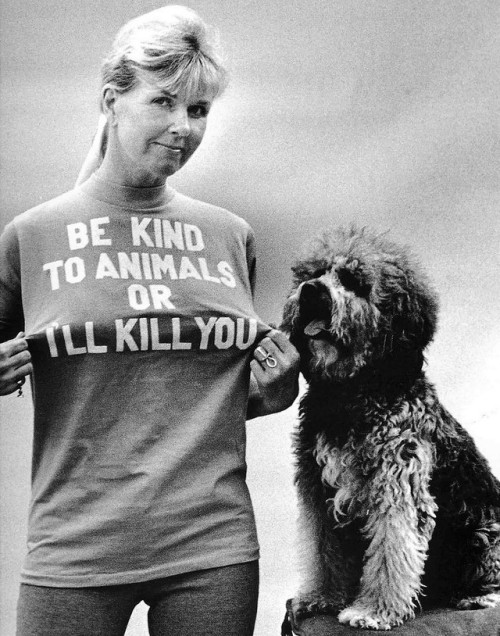

What a plain jerk head is he. Who would ever believe ruining the economy then fixing it actually fixes it? This is not what the farmers look like who he is robbing for, by the way:

US military explores plan to send 120,000 more troops to Middle East because Iran misbehaves. I imagine If you can read this, you have a brain. Now what?

Couple receives $2 billion from jury in Oakland because they got cancer from Roundup.

We farmers will get a bigger bail-out because Trump has a brain disease concerning China and trade.

Heaven help us.